What is Slippage?

Definition

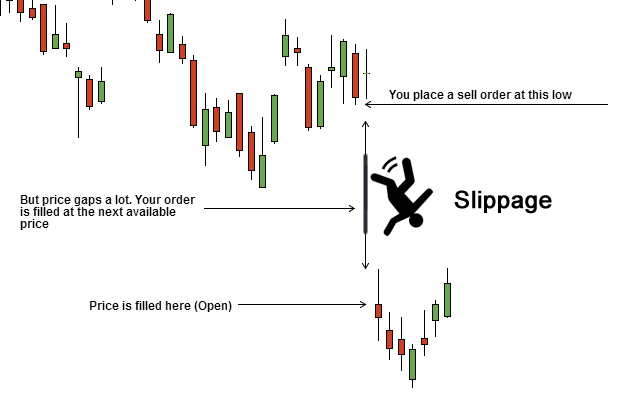

Slippage is the difference between the expected buy or sell price of a trade and the price at which the trade is executed.

Slippage can occur whenever higher volatility appears, most common in the case of “low liquidity”.

It also occurs when a large order is executed but the volume/liquidity at the chosen price is too scarce to maintain the current bid/ask spread.

However, as the forex market is popular for its huge liquidity (over-$50-billion trading volume recorded daily), slippage rarely happens.

Examples of Slippage

Slippage can lead to a Positive or Negative result. Let’s clarify its impact through the examples below!

Usually, slippage will be beneficial for TP but harmful for SL orders.

=> Trader’s profit increased by $1000

=> Trader’s loss increases by $1000

03 main terms of price

To clarify how Slippage works, you should notice 3 main terms of price.

Request Price

Request Price is the fixed one set by a trader when opening an order on the trading platform (MT5). It includes the price of Stoploss (SL), Take Profit (TP), pending orders (Buy/Sell Limit, Buy/Sell Stop), and Market Order.

Market Price

The Market price is the current one at which a currency pair is traded in real-time.

Match Price

The Match price is the executed one at the time of liquidation after the trader has placed an order.

For example under normal conditions, a trader sets the Request Price with TP of 1.1, when the Market Price moves to 1.1 and closes the order at 1.1, then the Match Price at this point will be 1.1.

In most cases under normal market conditions, the Request Price, Market Price, and Match Price are always equal.

When does Slippage happen?

Slippage will often occur when the market has a News/Event accompanied by strong volatility. All fixed events such as Nonfarm, CPI Core, Unemployment Rate, FOMC Meeting, Interest Rate decision, Monetary policy, Jackson Hole Conference, etc. are highly probable of price slippage.

How does slippage work?

Slippage occurs when the order has been liquidated at the Match Price which does not match the Request Price. As explained above with examples, the slipping Stoploss puts traders at a disadvantage while slipping TakeProfit benefits them.

Slippage & Brokers

Some brokers will consider Slippage as a way to make more profit. They customize the Match Price to be lower than the initial SL (causing worse slippage) and make traders lose more. If the price slips on TP orders, these brokers will set the Match Price without recording the difference.

In addition, many brokers do not partner with a number of strong LPs. This worsens price slippage as a result of poor liquidity in strong fluctuations caused by significant news.

Most brokers state in their service contracts that “order matching will depend on actual market fluctuations”. Therefore, traders are almost impossible to complain about the issue.

In FXCE, trading orders will always be committed to execution at the Market Price, in accordance with market activity.

FXCE always brings the best trading prices with a list of top liquidity partners worldwide. We are confident in providing our customers with the fastest order matching.

In the end

Slippage is completely unavoidable if a trader uses market orders. However, it can be minimized by choosing proper brokers who have multiple liquidity providers and do not interfere with Market Price. FXCE is one of them. Create an account here and start trading today at FXCE!